Financial Planning | December 20, 2017

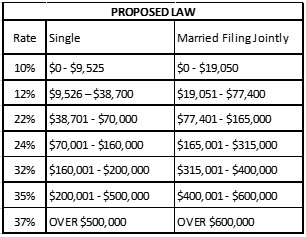

As we approach year-end, Congress has passed a new tax bill that will dramatically change the tax code beginning in 2018. The major changes include new tax brackets, lower top marginal tax rates, and significant changes to taxpayer deductions. For many taxpayers, filing your taxes will become less cumbersome and result in lower taxes. Some may see no change or worse: an increase.

Below is a summary of the key changes that will most affect taxpayers. Please recognize that the details described below do not reflect the entirety of the bill. We are paying close attention to the final details and we will be evaluating how these changes will impact your tax planning.

If you have any questions, we encourage you to contact your GW & Wade Counselor or you can reach us at lgerber@gwwade.com.

Despite much support for its elimination, the alternative minimum tax (AMT) has survived this round of tax reform. However, its bite will be reduced in two important ways. First, the income threshold at which the AMT kicks in has increased, so fewer taxpayers will be affected. Second, many of the tax deductions that push taxpayers into the AMT have been reduced or eliminated. As a result, the AMT will only apply in very specific circumstances, such as transactions involving incentive stock options (ISOs).

These changes affect taxpayers differently. For some taxpayers, the lower rates and increased standard deduction will both simplify and lower their taxes. For others, the results may result in no change or even higher taxes.

Because the deductions for taxes paid are reduced and the standard deduction is increased under the proposed law, it may benefit some taxpayers to prepay a portion of their real estate and personal property taxes for 2018 in 2017. However, Congress has expressly prohibited prepaying your state and local income tax for tax years beyond 2017. However, you can still pay your full 2017 state tax bill before year-end to ensure you benefit from the deduction.

For taxpayers that will find themselves in the standard deduction in 2018 under the proposed law and make regular annual contributions to charity, you may also want to consider making a large year-end contribution to a donor advised fund. This allows you to make a deductible contribution to a fund under your control, rather than directly to a charity, that you can control and distribute to charities over the course of several years.

The child tax credit will be expanded to provide more benefits to even more taxpayers. The total allowable credit is increased to $2,000 per child, up from the current $1,000 per child. Of this, up to $1,400 per child is refundable for taxpayers with little to no tax liability. In addition to the higher credit amount, the income thresholds have been expanded to make more people eligible for the credit. Specifically, the income threshold has increased to $200,000 (single) and $400,000 (married filing jointly), up from $75,000/$110,000.

The original proposal that would have eliminated the estate tax completely failed to take hold, so the estate tax is still in place. However, the current bill would double the current exemptions from $5.6 million in 2018 to $11.2 million per person (indexed for inflation). The bill also retains the portability provisions, which allow married taxpayers to combine their estate tax exemptions for use by the survivor.

The qualified use of 529 plans has been expanded to include payments for private elementary and high schools. Under current law, these plans can be used only for college expenses. However, payments to these new sources is limited to $10,000 per year, whereas there are no limits on payments for qualified college expenses.

The bill provides for a 20% deduction on individual earnings from pass-through businesses such as S Corps, partnerships, LLCs, and sole-proprietors. The deduction is limited for taxpayers with taxable income exceeding $315,000 for joint filers ($157,500 for other filing statuses). In the case of individuals with pass-through earnings from certain service industries, such as lawyers, doctors, accountants, and investment managers, the deduction begins to phase-out at lower levels of income.

Again, if you have any questions, we encourage you to contact your GW & Wade Counselor or you can reach us at lgerber@gwwade.com.

The information above is general and educational in nature and should not be considered legal or tax advice. Tax laws and regulations are complex and subject to change. GW & Wade cannot guarantee that this information is accurate, complete, or timely. We make no warranties with regard to such information or results obtained by its use. Always consult an attorney or tax professional regarding your specific situation.

Clients of the firm who have specific questions should contact the GW & Wade Counselor with whom they regularly work. All other inquiries, including any inquiry concerning a potential advisory relationship with GW & Wade, should be directed to:

Laurie Gerber, Client Development

GW & Wade, LLC

T. 781-239-1188

We’ll send you timely commentary covering investing, taxes, equity compensation, and more.

Copyright © 2022 GW & Wade - All Rights Reserved | Disclosures | Terms of Use

Investment advisory services offered through GW & Wade, LLC